What Does Hard Money Atlanta Do?

Wiki Article

Facts About Hard Money Atlanta Revealed

Table of ContentsUnknown Facts About Hard Money AtlantaA Biased View of Hard Money AtlantaThe 7-Second Trick For Hard Money AtlantaExamine This Report on Hard Money AtlantaExamine This Report on Hard Money AtlantaLittle Known Questions About Hard Money Atlanta.

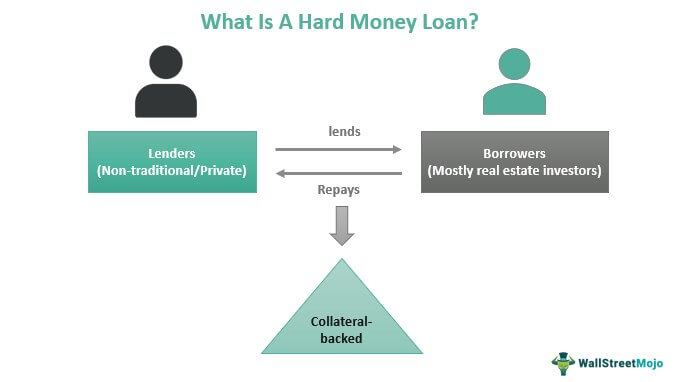

They are both offered by independent financiers such as business and also people. Both loans are likewise structured with brief terms. Lenders additionally anticipate month-to-month interest-only repayments as well as a balloon repayment at the end of the financing. When it comes to passion rates, bridge lendings are somewhat lower. The variety is generally between 6% and 10% for bridge fundings, while tough cash car loans vary from 10% to 18%.You can secure it even if you have a background of foreclosure. The property is authorized as security, which is the only defense a loan provider relies upon in situation you default on your lending. Hard money lending institutions primarily establish finance authorization and also terms based upon the residential or commercial property utilized as collateral.

When it comes to deposit, 20 percent to 30 percent of the finance amount is needed. Some difficult cash carriers might require 10 percent down payment if you are a knowledgeable home flipper. Expect a Lower Loan-to-Value Proportion The majority of tough money lenders adhere to a reduced loan-to-value (LTV) ratio, which is 60 percent to 80 percent.

5 Easy Facts About Hard Money Atlanta Shown

The lower LTV suggests tough cash lending institutions do not supply as much financing as conventional commercial sources. If you fail on your lending, a lender can count on marketing your residential or commercial property rapidly.Tough cash financings have a price of 10 percent to 18 percent. At the same time, typical industrial lendings commonly have rates in between 1. 176 percent to 12 percent. In this regard, hard cash car loan rates can be higher than subprime commercial lendings. The enhanced cost is indicative of the high risk lending institutions face when they use this kind of funding.

To provide you an instance, let's claim you gotten a hard money funding at $800,000 with 12 percent APR.

Utilizing the calculator above our page, allow's estimate your monthly interest-only repayment, principal and rate of interest settlement, pop over here as well as overall balloon repayment. Settlement Type, Quantity Interest-only payment$8,000.

By the end of the 2-year term, you should make a balloon payment of $793,825. Hard cash financings have ended up being a typical funding alternative for home flippers that can not access industrial lendings from financial institutions.

Some Known Facts About Hard Money Atlanta.

In various other circumstances, an actual estate bargain might not pass stringent guidelines from a typical lender. For these factors, home fins count on tough cash finances. House flippers are real estate financiers that acquire property to take care of and also cost a higher revenue. They require sufficient cash to fully money a deal.Once they are able to make a sale, they can pay back the lending. On the other hand, if a home flipper defaults, the hard money lending institution can seize or take possession of the building.

7 Easy Facts About Hard Money Atlanta Described

In other situations, when it comes to experienced residence flippers, lending institutions allow the interest to build up. Hard cash lenders might also not be as important with repayment.Greater rate of interest rates over at this website is a significant disadvantage for tough cash car loans. In general, it sets you back more than conventional business loans.

Rumored Buzz on Hard Money Atlanta

If you're source fee is 3 percent and your funding is $850,000, your origination cost would certainly cost $25,500. Nevertheless, if your origination cost is 1 percent, it will just be $8,500. In addition, some lenders might not provide financing due to stringent realty compliance regulations. This depends upon the jurisdiction of your owner-occupied commercial residential property.The greatest threat is losing your home. If you fail on your loan or stop working to refinance early, tough money lending institutions can take your home and also offer it on their very own.

Lenders might not be as stringent regarding settlement as financial institutions. They may still make a great earnings even if you skip on your finance. Some lenders could reject funding for owner-occupied building due to the fact that of rigorous property conformity regulations. To touch difficult cash funding companies, you can obtain in touch with property representatives as well as investor groups.

Report this wiki page